Published April 16, 2020

“So, How’s the Market?”

Royal LePage recently released a 2020 home price forecast for our national and nine largest real estate markets as well as first-quarter data for our largest 64 real estate markets.

In general terms, if these strict stay-at-home restrictions are eased heading into the second quarter of the year, the overall national forecast sees home prices in 2020 staying relatively flat. If these restrictions stick around for another quarter (which is entirely possible, so please stay home!), it is possible we will see a 3% decline in home prices year-over-year.

Heading into March, our local Metro Vancouver Real Estate market was finally pulling itself out of the long, slow grind of 2019. We were seeing multiple offers popping up, homes being snatched up before open houses, and a solid increase in Buyer activity that we hadn’t seen in well over a year. Unfortunately, that all changed overnight, with the swift onset of COVID-19 and the essential freezing of our lives and businesses across the country. Some Buyers and Sellers were caught in the middle – either they had already sold their homes and not yet purchased, or needed to buy (or sell) for a multitude of reasons, and their ability to purchase a home had been severely restricted overnight. Fortunately for them, our government has deemed Real Estate services and Realtors an essential service, to ensure these people are still able to find shelter and not be left out in the cold.

After a brief pause in activity to regroup, Realtors have rapidly adjusted to a new normal, with the public’s health and safety at the forefront. Realtors have adapted best practices and showing protocols, and they are utilizing tools such as Matterport 3D cameras to virtually show homes. They are also conducting live, streaming virtual open houses to allow purchasers to conduct in-depth property viewings from the comfort of their own living room.

In times of economic uncertainty, there will always be someone looking to take advantage of distressed sellers, or some expectation that housing prices will ‘crash’. Home price declines occur when the market experiences sustained low sales volume while inventory builds. As of today, all indications are that the pent-up demand that is building while the public stays home, combined with low interest rates and low inventory will see a brisk level of activity when we return to a more normal state of living.

“It is easy to mistakenly equate a handful of transactions at lower prices to a reset in the value of the nation’s housing stock. Distressed sales that occur during an economic crisis are a poor proxy for real estate value.” ~Phil Soper, President & CEO, Royal LePage Canada.

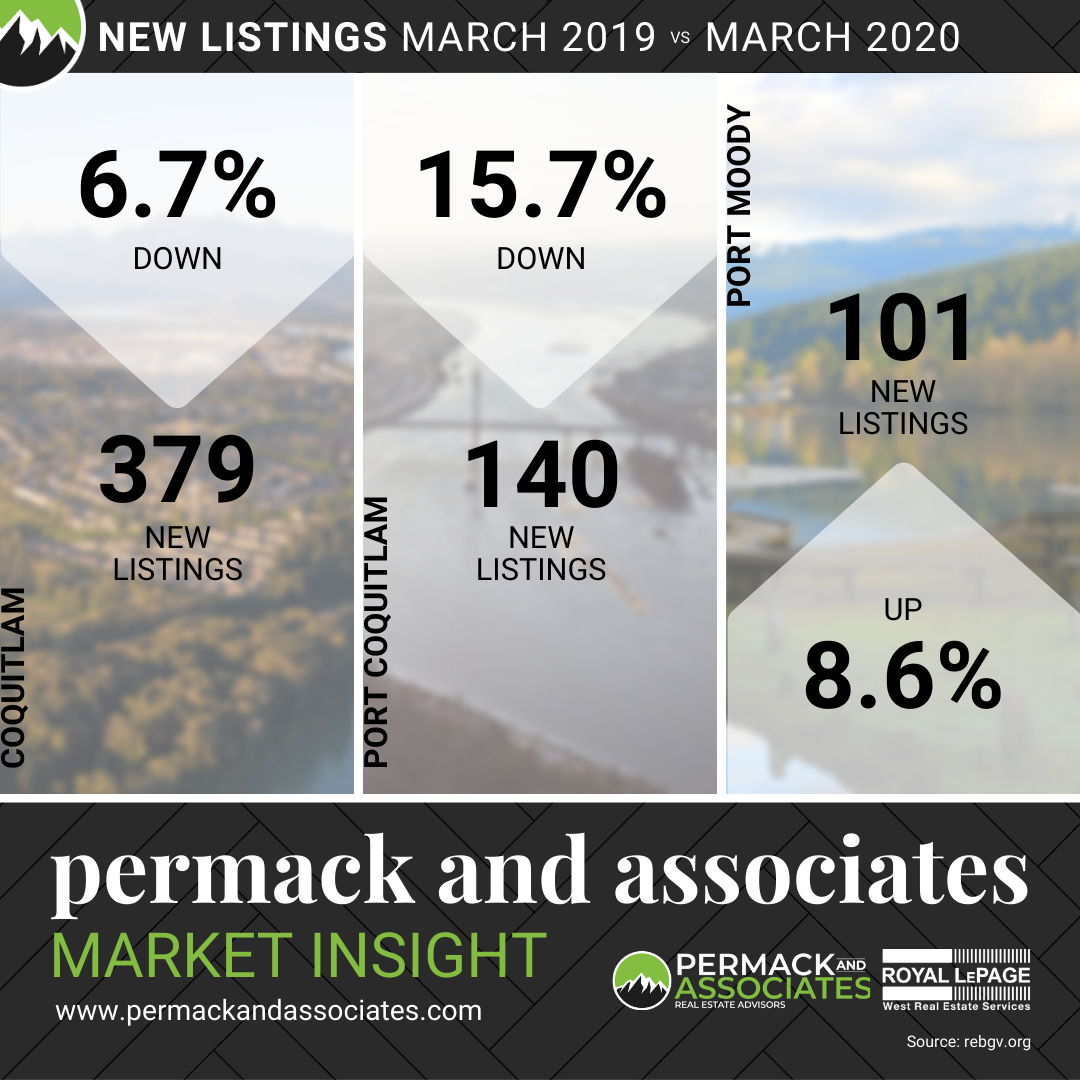

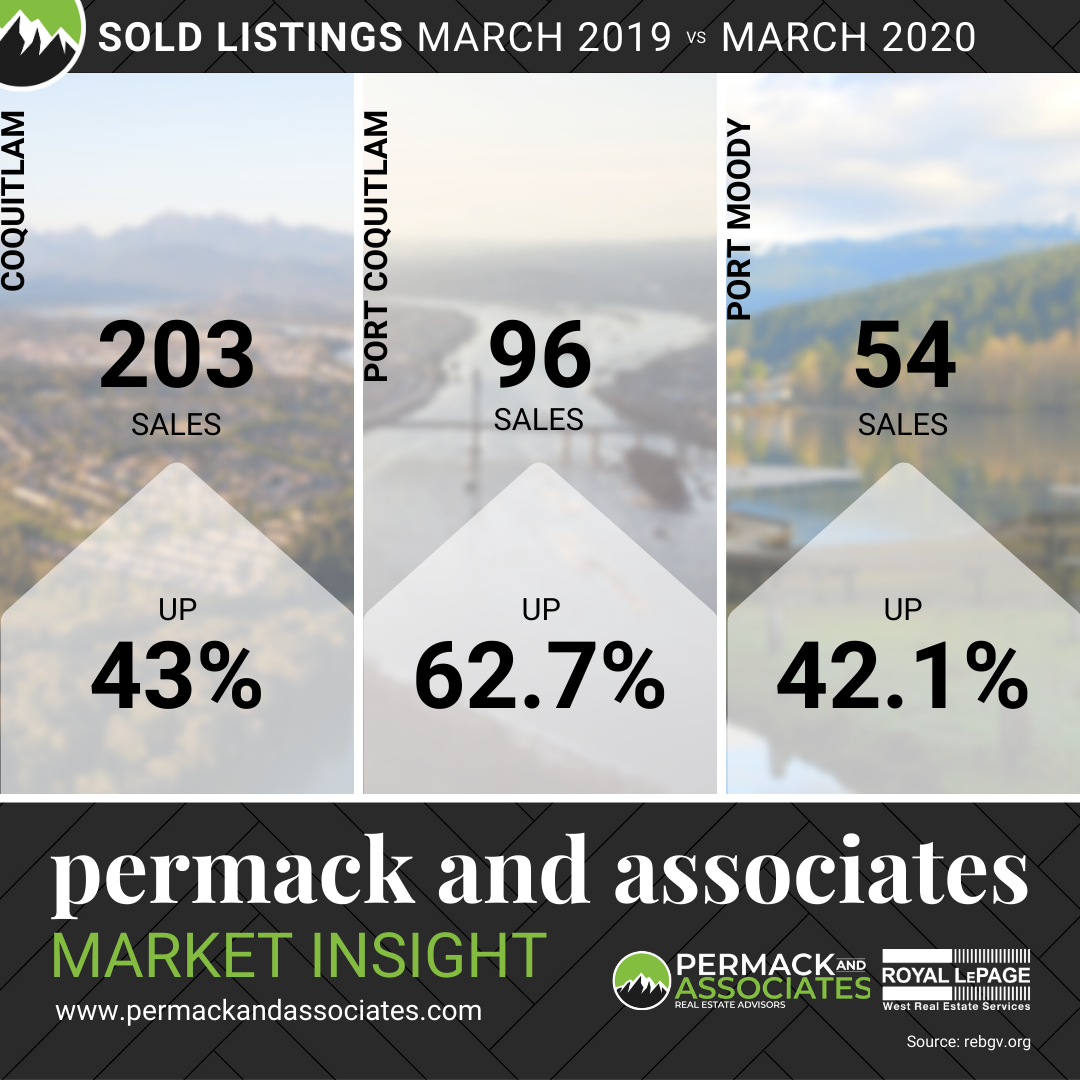

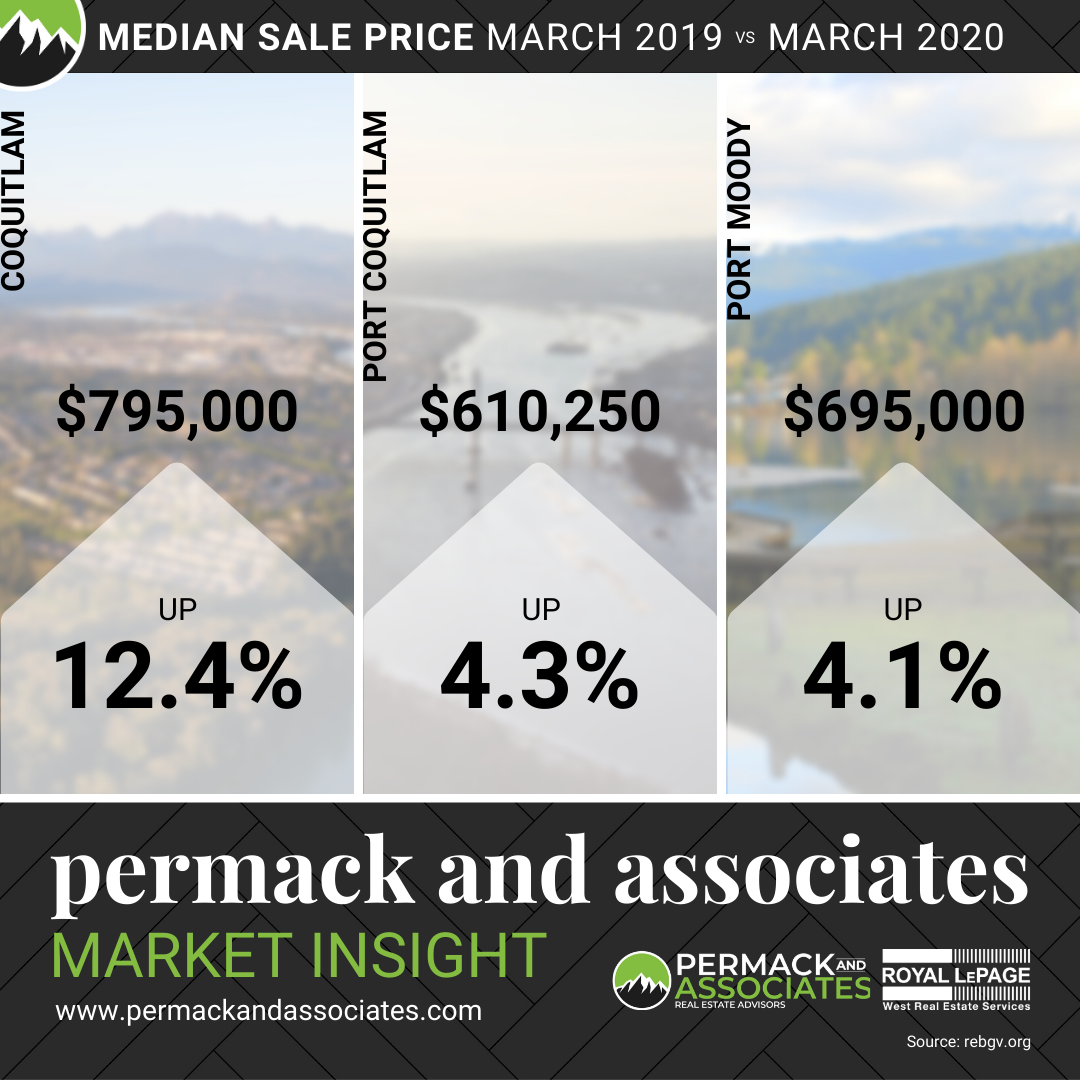

Let’s look at the aggregate numbers for the Tri-Cities. The number of new listings in March 2020 dropped about 7% from March 2019 across all product types, while the number of sales was up 48% for the same timeframe. Considering the March 2020 numbers essentially only reflect the first two weeks of the month, it’s fair to hypothesize that the sales would have far surpassed the 48% increase. The median sale prices for all housing product types were up across the board for March 2020, and again, all accounts were trending towards a strong spring market.

While no definitive numbers have been reported yet for the first two weeks of April, it’s safe to say we can expect to see a sharp decline in the number of transactions (as of writing this, there have been 16 firm sales reported on MLS since April 1st, compared to 179 in the same time period last year). Whether or not sale prices follow remains to be seen, but as Buyers and Sellers become more comfortable with the new ‘normal’ of virtual showings and offers, I am confident we will start to see activity pick up, even if our lives are nowhere near ‘normal’.